Short Put Calendar Spread - Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web short put calendar spread. Buying one put option and selling a second put option with a more distant expiration. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a short put calendar spread is another type of spread that uses two different put options.

Short Put Calendar Spread Options Strategy

Buying one put option and selling a second put option with a more distant expiration. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web short put calendar spread. Web a calendar spread is an options or futures strategy where an investor simultaneously.

Calendar Spread Options Trading Strategy In Python

Web a short put calendar spread is another type of spread that uses two different put options. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web short put calendar spread. Web a long calendar spread—often referred to as a time spread—is the.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web short put calendar spread. Web a short put calendar spread is another type of spread that uses two different put options. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Buying one put option and selling a second put option with a more distant expiration. Web a short.

Trading Guide on Calendar Call Spread AALAP

Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web a short put calendar spread is another type of spread that uses two different put options. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Buying.

Short Put Calendar Short put calendar Spread Reverse Calendar

Buying one put option and selling a second put option with a more distant expiration. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a short calendar spread.

Calendar Spread Explained InvestingFuse

Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web short put calendar spread. Buying one put option and selling a second put option with.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Buying one put option and selling a second put option with a more distant expiration. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a short put calendar.

Short Bond Trade Using a Put Calendar Diagonal Option Spread [TLT

Web a short put calendar spread is another type of spread that uses two different put options. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web short put calendar spread. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or.

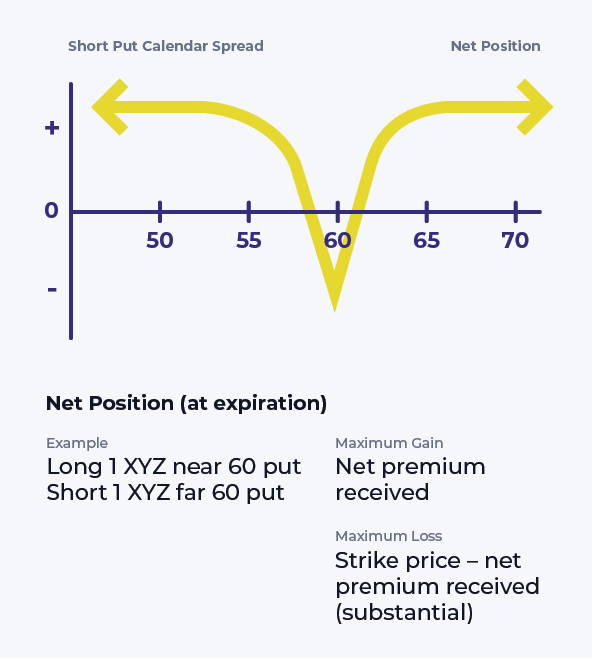

Buying one put option and selling a second put option with a more distant expiration. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a short put calendar spread is another type of spread that uses two different put options. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer. Web short put calendar spread.

Web A Short Calendar Spread With Puts Realizes Its Maximum Profit If The Stock Price Is Either Far Above Or Far Below The Strike Price On.

Web a short put calendar spread is another type of spread that uses two different put options. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short. Buying one put option and selling a second put option with a more distant expiration. Web short put calendar spread.

Web A Long Calendar Spread—Often Referred To As A Time Spread—Is The Buying And Selling Of A Call Option Or The Buying.

Web short put calendar spread (short put time spread) this strategy profits from the different characteristics of near and longer.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)